After two days, liability can climb to $500 or more, but many banks provide additional voluntary protections. For debit cards, liability for an unauthorized transaction is limited to $50 if it's reported within two business days of the date a cardholder learns of it. Department of Justice, but in most cases a cardholder's liability is limited to $50 for a lost or stolen credit card. More than 80 percent of what's been called identity theft involves fraudulent charges on existing accounts, according to the U.S. Even the statistic of 8 million victims overstates the danger. Take the threat seriously, but don't panic.

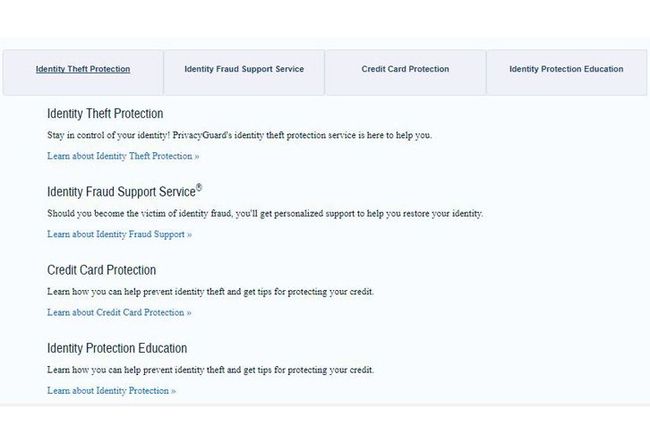

And consumers have become more eagle-eyed about their own accounts, without the need for a paid subscription service. More significant, identity fraud is down because financial institutions are doing a better job preventing it. As of last fall, Experian Protect MyID was also still claiming that ID theft is "one of the fastest-growing crimes." The latest available data show that in 2010 identity fraud fell 27 percent, to 8.1 million victims. That promo, which ran in November 2011, was based on statistics that were out of date. "And with a growing 11 million victims each year, one of those identities could be yours." "There were 1.2 million more victims in 2009 than 2008," Chase warned on its website. Some ID protectors scare up business with inflated claims about crime. We dug into the latest products sold by more than two dozen banks, credit-reporting bureaus, and independent companies. And some promoters of these services have been slapped by the Federal Trade Commission for misleading sales practices and false claims. In the past we've found that these protection plans provide questionable value. In a sense, consumers who buy this protection from their banks are helping to foot the bill for services that financial institutions are obligated to provide by federal law to shield their customers from losses stemming from credit-card and bank-account fraud. More of these pitches are coming from banks, which account for more than half of the $3.5 billion a year spent on ID-theft protection subscriptions. Some throw in up to $1 million in insurance. Those services, which cost about $120 to $300 a year, promise to protect your ID by monitoring your credit reports 24/7, scouring "black-market chat rooms" for your personal information, removing your name from marketing lists, and filing fraud alerts. PrivacyGuard and Credit Alert are registered service marks of Affinion Publishing, LLC.Almost 50 million people subscribed to some form of identity-theft protection in 2010. PrivacyGuard is not available to residents of Iowa, Rhode Island and Vermont.

Any part of the service may be modified or improved at any time and without prior notice. does not receive any compensation from the sale of the identity theft insurance benefit included as part of the PrivacyGuard service. PrivacyGuard is a service of Trilegiant Corporation in conjunction with Trilegiant Insurance Services, Inc. Trilegiant Corporation, Trilegiant Insurance Services, Inc., and Alliance Marketing Association and their credit information subcontractors shall not have any liability for the accuracy of the information contained in the credit reports, credit scores, Credit Alert ® reports or other reports which you receive in connection with the PrivacyGuard service, including any liability for damages, direct or indirect, consequential or incidental.

©2023 Trilegiant Corporation, 6 High Ridge Park, Stamford, CT 06905

0 kommentar(er)

0 kommentar(er)